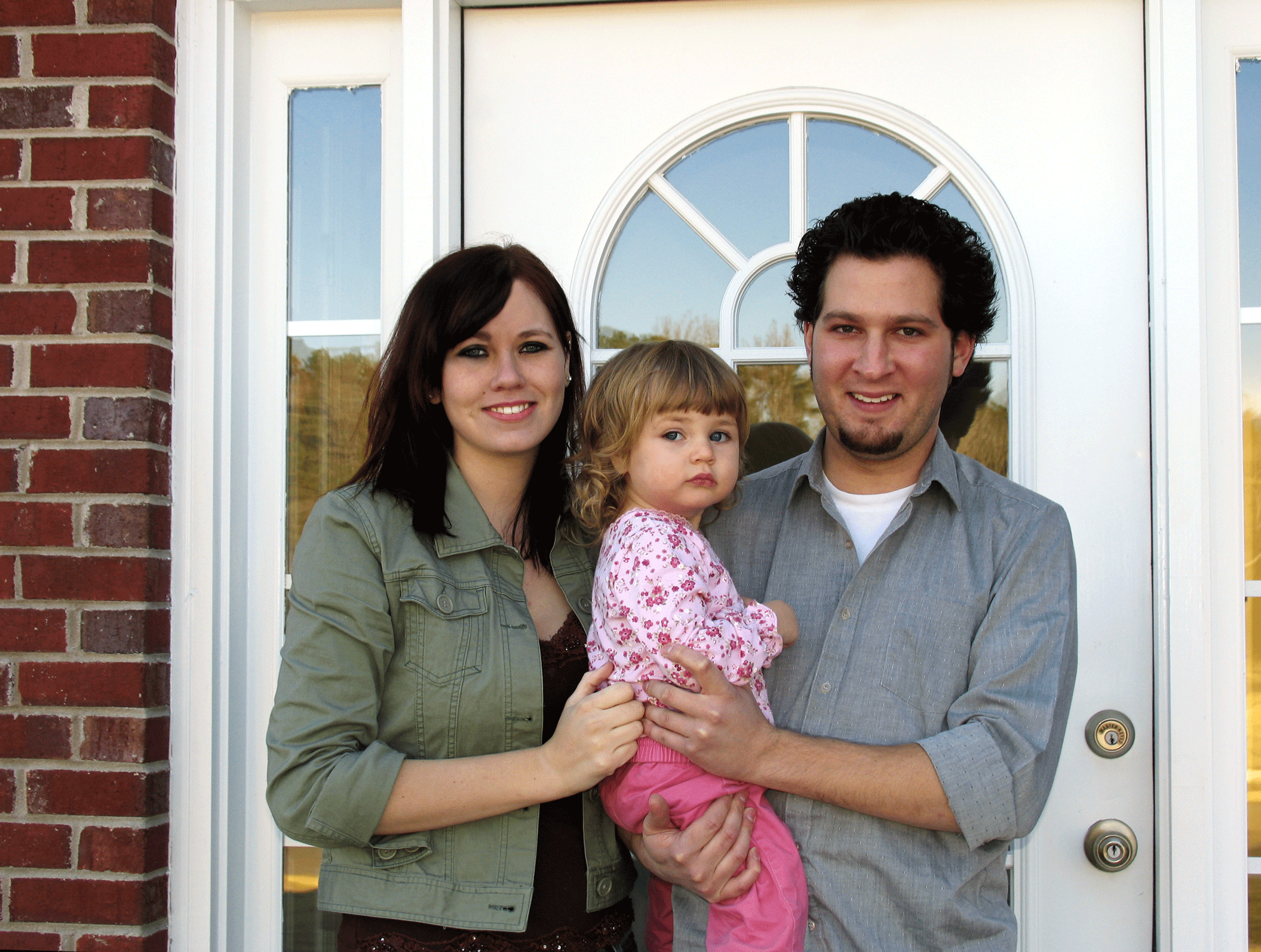

Hometown, personal feel with the power of a national lending institution

how can we help you?

I am a...

Renter

Selecting the right mortgage loan to finance your first home can feel like a daunting task. At Trust In Equity we take the time to get to know our clients so we can help them select the mortgage that best fits their situation.

First Time Home Buyer

Nervous about your first big purchase? With all the different programs available it can be difficult to determine which mortgage loan is right for you and your family. We can help!

Current Homeowner

When looking to upgrade to a new home for you and your family the last thing you want to worry about is mortgage financing. At Trust In Equity, we are thorough and upfront in our application process. Find out how we can help!

Veteran

Did you know that loans for veterans are the most underutilized type of mortgage loan in the United States? As somebody who served our great country, you deserve to enjoy the many benefits of a VA loan.

Investor

As a real estate investor who is trying to build wealth, it can be challenging to find a broker who understands your unique goals and needs. As investors ourselves, we can help you not only to obtain financing but also offer our insight into real estate investing.

Divorce Refinance

Going through a divorce is an exhausting process. Emotions are high, opinions can differ, and your home is a very important asset to manage. We have learned how to take a sensitive and well-rounded approach to come up with the best options for both parties.

About Trust in Equity

Based out of Avon, OH, we are private mortgage brokers who are qualified to help individuals and families finance their homes. We offer flexible appointments, competitive rates, and simple application and approval processes to all of our clients. Not located near our Avon office? No need to worry. We can discuss the documents required and walk you through things over the phone. We can also easily accept the required documents by fax or email.

Buying a new home shouldn’t put you in debt for the rest of your life. With many loan packages and interest rate options to consider, we can help you secure a mortgage that best suits your needs.

We Shop for the best rates so you don't have to

Let the experts do all the work for you...

OUR SERVICES

Conventional Loan

Conventional loans offer competitive interest rates and are an excellent choice for first-time home buyers or for families who have outgrown their house and need to upgrade.

FHA Loans

These loans are great for first-time home buyers who want to begin building equity in a home for themselves and their family’s future.

VA Loans

VA Loans are available to anyone who has served or is currently serving in any branch of the United States Military. VA loans have many benefits, including the option of putting no money down.

USDA Rural Development Loans

If you’re ready to experience the benefits of home ownership, the US Department of Agriculture may be able to help make it possible.

Jumbo Loans

Buying a large and expensive home? Are you worried about high rates on your mortgage loan? High-income earners should be aware of Jumbo Loans and the effects it can have on your rates.

First Mortgage Loans

Navigating the complex waters of securing a mortgage can be a daunting experience. As a first-time borrower, you need solid advice and personalized service, Trust in Equity is here to help!

Home Affordable Refinance Program

If you’re struggling to stay in your home, you may qualify for the HARP loan program.

Conventional Refinancing

These types of loans are great for homeowners looking to shorten their term or investors who need capital for their next purchase.

FHA Streamline

Purchase your home with an FHA Loan? This program allows you to refinance with less expenses than with traditional loans.

Jumbo Refinance

Refinancing your home with a jumbo refinance can lower your monthly payments, overall interest expense, and allow cash out on your home's equity.

Refinancing

Refinancing is a great way to secure a lower monthly mortgage payment or a more manageable interest rate. If you have credit card bills or other debts to pay, refinancing can help you get back on your feet.

View Cart []

View Cart []